Hong Kong Tariffs on Us Beef

Tiptop 10 U.S. Agricultural Exports to Hong Kong(values in million USD) | |||||||

| Commodity | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Modify | 2016-2020 Average |

| Beefiness & Beef Products | 684 | 884 | 964 | 746 | 666 | -11% | 789 |

| Tree Nuts | ane,156 | 1,251 | 1,052 | 692 | 271 | -61% | 884 |

| Prepared Food | 232 | 169 | 228 | 191 | 186 | -iii% | 201 |

| Fresh Fruit | 281 | 291 | 237 | 194 | 181 | -7% | 237 |

| Poultry Meat & Products* | 426 | 469 | 431 | 353 | 107 | -lxx% | 357 |

| Pork & Pork Products | 360 | 415 | 282 | 154 | 91 | -41% | 260 |

| Dog & Cat Food | 40 | 50 | 62 | 57 | 68 | 21% | 55 |

| Wine & Beer | 101 | 120 | 131 | 114 | 65 | -43% | 106 |

| Processed Vegetables | 54 | 49 | 53 | 54 | 42 | -21% | 50 |

| Eggs & Products | 39 | 38 | 46 | 46 | 39 | -xv% | 42 |

| All Other | 459 | 477 | 473 | 391 | 302 | -23% | 422 |

| Full Exported | three,832 | 4,213 | 3,959 | 2,992 | 2,018 | -33% | iii,403 |

Source: U.S. Census Bureau Trade Information - BICO HS-x

*Excludes eggs

Highlights

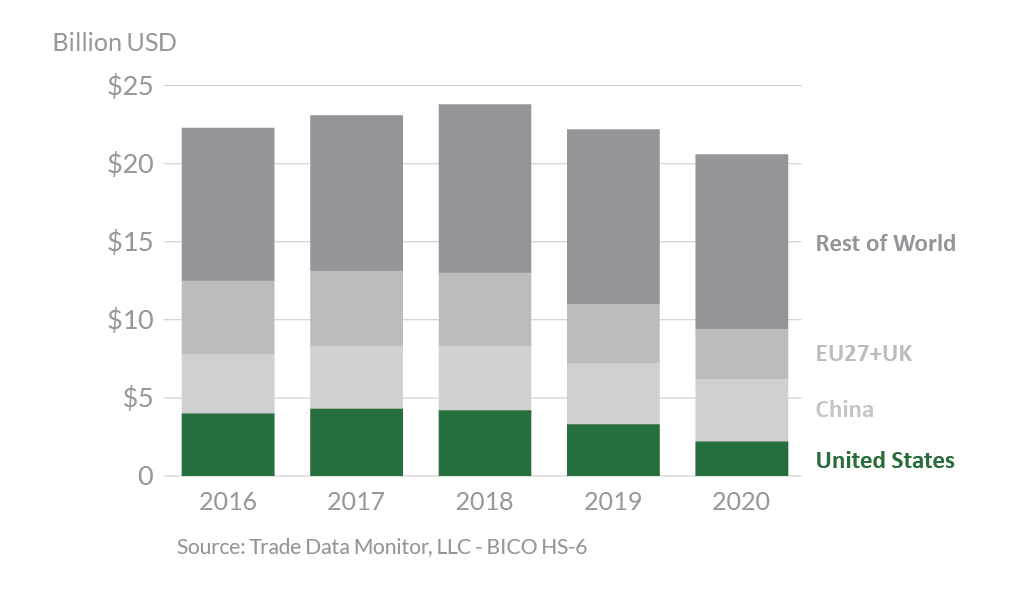

In 2020, Hong Kong was the 12th largest destination for U.S. food and agricultural exports, totaling $2 billion. This represents a 33-per centum decrease from 2019. In 2020, Hong Kong also remained the sixth-largest market for consumer-oriented agronomical exports, valued at more than $1.8 billion, or 86 percentage of U.S. agronomical exports to Hong Kong. The U.s.a. was the third-largest supplier of agricultural goods with 11 percent market share, backside People's republic of china with 19 pct and the EU27+Great britain with 16 percent. The downward export trend to Hong Kong in 2020 was largely due to travel constraints in reaction to the global outbreak of COVID-19. Additionally, an increase in direct U.South. agronomical exports to Communist china reduced the frequency of transshipment through Hong Kong, resulting in a subtract in U.S. agronomical exports to Hong Kong. Hong Kong is the fifth-largest export market place for U.S. beef at more than $665 million, the sixth-largest marketplace for fresh fruit at $180 million, the seventh-largest marketplace for wine at $64 million, and the seventh-largest market for fish products at $123 million. Among the few products that saw increases to Hong Kong in 2020 were domestic dog & cat food and cotton, which grew $11 1000000 and $3 million, or 21 and 58 percent, respectively. Exports of poultry meat & products (excluding eggs), beef & beefiness products, and pork & pork products fell last year past $246 million, $lxxx million, and $63 million, respectively.

Drivers

- In Jan 2020, Hong Kong was one of the first places outside of China to ostend cases of COVID-19. The Hong Kong Government has implemented stringent measures to command the spread of the coronavirus, finer shutting downward the disquisitional leisure tourism sector. Prior to the pandemic, Hong Kong was the about visited destination in the world, fueling the demand for loftier-value U.S. agricultural exports for the hospitality manufacture.

- While the sales of premium products to the Hotel, Restaurant, and Institutional food service sector have been adversely affected, retail sales of food products in supermarkets accept increased as people cook at home more every bit a event of public health measures.

- Direct U.S. agricultural exports to mainland Red china increased, decreasing the likelihood of transshipment of goods through Hong Kong.

Hong Kong'south Agricultural Suppliers

Looking Ahead

Hong Kong will go on to be an important market place for U.S. agricultural and nutrient exports, free from tariffs and taxes. More 95 percent of Hong Kong'due south food supplies are imported, and U.S. products are well received by Hong Kong consumers because of enforceable U.S. food prophylactic standards and the consistent quality of U.S. products. While ongoing political tensions may reduce Hong Kong's desirability as a business concern eye for international companies, the jurisdiction, every bit a free port that allows for the free flow of goods and capital, continues to play an of import role in introducing and establishing U.Southward. products for the larger Asian marketplace. As Hong Kong and the broader global economy sally from the coronavirus pandemic, U.South. agronomical exports should exist able to recover some lost footing in Hong Kong.

<< Return to Full Yearbook

Source: https://www.fas.usda.gov/hong-kong-2020-export-highlights

Belum ada Komentar untuk "Hong Kong Tariffs on Us Beef"

Posting Komentar